Looking for aztaxes gov? Find top links for easy and hassle-free access to the where’s my refund make a payment?

Table of Contents

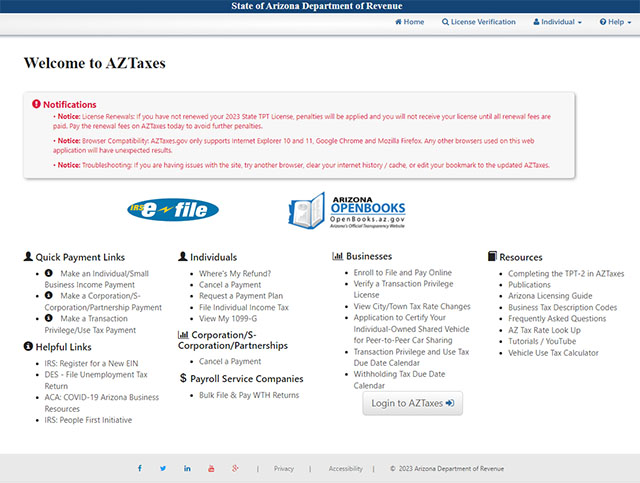

1. AZTaxes.gov

https://www.aztaxes.gov/

Notice: License Renewals: If you have not renewed your 2023 State TPT License, penalties will be applied and you will not receive your license until all renewal …

Visit Site2. Login

https://www.aztaxes.gov/Home/Login

Login. Business User Login. New User Enrollment?

Visit Site3. AZ Individual Tax Payments

https://aztaxes.gov/Home/PaymentIndividual/

Individual Payment Type options include: 140V: Payment

Visit Site4. Arizona Department of Revenue

https://aztaxes.gov/Home/Page1

Pay the renewal fees on AZTaxes today to avoid further penalties

Visit Site5. Contact Us

https://aztaxes.gov/Home/ContactUsPage

Hours of Operation: 8:00 am – 5:00 pm MST Monday through Friday

Visit Site6. Arizona Department of Revenue: Home

https://azdor.gov/

File your business taxes, apply for a license, or pay the majority of taxes online at AZTaxes.gov. … ADOR has been named “Top Companies to Work for in Arizona” …

Visit Site7. AZTaxes User Access

https://azdor.gov/transaction-privilege-tax/tpt-license/aztaxes-user-access

AZTaxes.gov features the ability to maintain delegate users privileges. You will need to register for an AZTaxes account to use our business services.

Visit Site8. AZTaxes.gov Onboarding for State Agencies

https://gao.az.gov/sites/default/files/2023-06/AZTaxes.gov%20Onboarding%20for%20State%20Agencies%20-.pdf

Registering on AZTaxes is a 3-step process: o Enroll your user name. o Set up your e-signature pin. o Account Linking (will be completed by. ADOR for web

Visit Site9. Finance Taxes

https://www.phoenix.gov/finance/plt/taxes

Businesses are required to report and pay Phoenix privilege sales tax on their taxable business activity on a monthly, quarterly, or annual frequency. Reporting …

Visit Site10. Arizona Tax Payment Instructions

You can make a payment using major credit cards, debit cards and e-checks. Step by step guide to make Arizona tax payment. Step 1: Go to https://aztaxes.gov

Visit Site11. FAQs • Casa Grande, AZ • CivicEngage

https://www.casagrandeaz.gov/FAQ.aspx?QID=234

Go to AZTaxes.gov. Log in using your username and password. Click “License Renewal” in the ‘Action’ section of your Business List or select “License Renewal” on …

Visit Site12. Sales Tax (Transaction Privilege Tax) | Queen Creek, AZ

https://www.queencreekaz.gov/business/sales-tax

Visit aztaxes.gov to determine the right state, county and town tax rate for your specific business category. Queen Creek – Region Code “QC” QC Sales Tax Rates.

Visit Site13. City Tax Information | Douglas, AZ

https://www.douglasaz.gov/493/City-Tax-Information

On AZTaxes.gov, taxpayers can do the following: Change their mailing address. Add, edit, and close locations. Cancel or close an existing TPT license

Visit Site

Also Read: azmvdnow.gov | mvd motor vehicle services